The Psychology of Minimalism vs. Frugality: Why Mindset Matters

- jennifercorkum

- Sep 30

- 4 min read

When people talk about saving money, they often frame it in terms of tactics: clip coupons, declutter your closet, avoid impulse buys. But behind every tactic lies something more powerful—your mindset.

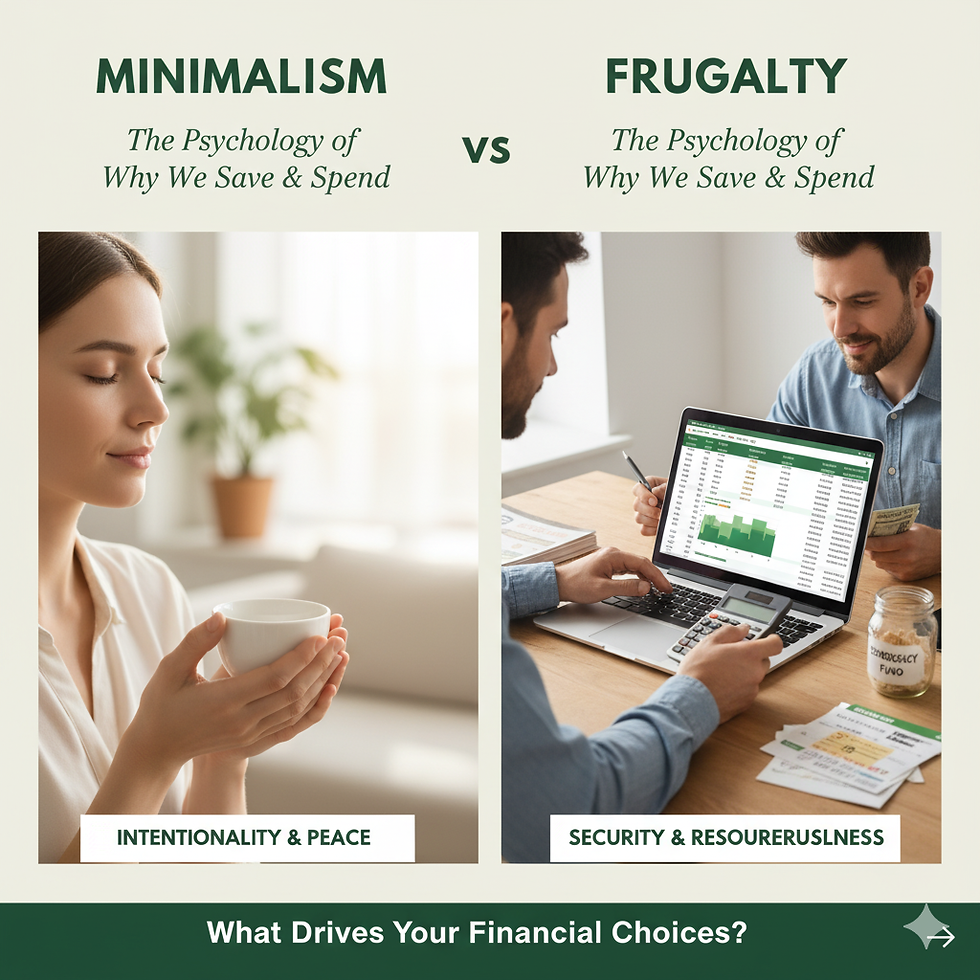

This is where the real distinction between minimalism and frugality shows up. It’s not just about what you buy (or don’t buy). It’s about why you make those choices. Understanding the psychology behind each approach can transform how you manage your money and, more importantly, how you feel about it.

The Minimalist Mindset

Minimalism is rooted in intentionality. At its core, it asks: What truly matters to me, and how can I align my resources with those priorities?

Psychologically, minimalists often:

Value freedom over accumulation. They see possessions as potential distractions rather than status symbols.

Seek clarity. By removing excess, they reduce decision fatigue and mental clutter.

Embrace quality over quantity. Instead of chasing bargains, they’re willing to pay more for items that last or bring genuine joy.

A minimalist doesn’t buy fewer things just to save money—they buy fewer things to live a life of focus, peace, and meaning.

Example: A minimalist might pay extra for a laptop that supports their creative work because it aligns with their value of pursuing meaningful projects. The higher cost isn’t seen as wasteful—it’s an investment in freedom and purpose.

The Frugal Mindset

Frugality, by contrast, is rooted in resourcefulness. The central question is: How can I meet my needs while spending the least amount possible?

Psychologically, frugal individuals often:

Value security. They feel most comfortable when their money is stretched and their budget is lean.

Find satisfaction in efficiency. A deal, a coupon, or a DIY project isn’t just about saving money—it’s about outsmarting waste.

Focus on sacrifice in the short term for long-term gain. Frugality often thrives in goal-driven contexts like paying off debt or building savings.

A frugal person doesn’t necessarily reject possessions—they reject overpaying. The joy comes from knowing they kept their spending tight.

Example: A frugal person might choose a refurbished laptop instead of a brand-new one. It gets the job done at a fraction of the cost, freeing up cash for other priorities.

Emotional Drivers: Minimalism vs. Frugality

The psychology of these two lifestyles isn’t just rational—it’s emotional. Here’s how feelings often play into each approach:

Minimalism is driven by a desire for peace, simplicity, and alignment. Purchases (or the lack of them) are emotionally tied to meaning and identity.

Frugality is driven by a desire for security, control, and efficiency. Purchases (or the avoidance of them) are emotionally tied to savings and protection.

Neither is wrong. But your emotional drivers can shape how sustainable each approach feels. For example, if you crave simplicity but constantly chase discounts, you may end up with clutter you don’t even like. If you crave security but buy expensive “minimalist” products, you may feel financial anxiety.

The Pitfalls of Each Mindset

While both minimalism and frugality offer powerful tools for financial freedom, each mindset has potential downsides if taken too far.

Minimalist Pitfalls

Justifying overspending. It’s easy to rationalize expensive purchases as “quality over quantity” when they’re really indulgences.

Perfectionism. Constantly curating your life to be “minimal” can create pressure instead of peace.

Neglecting financial goals. A minimalist might overspend on fewer, high-quality items and forget the bigger picture of savings or debt reduction.

Frugal Pitfalls

Penny wise, pound foolish. Always opting for the cheapest option can lead to higher costs when items wear out or break.

Scarcity mindset. Frugality can slip into fear-based decision-making, where every purchase feels risky.

Joy deprivation. If saving money becomes the only goal, life can start to feel restrictive and joyless.

Psychological Benefits of Minimalism

Despite its pitfalls, minimalism offers rich psychological rewards:

Mental clarity. Fewer possessions mean fewer decisions, less stress, and more focus.

Deeper satisfaction. Spending in alignment with values increases contentment.

Freedom from comparison. Minimalists often care less about keeping up with societal or cultural consumption norms.

In essence, minimalism shifts the focus from how much you spend to why you spend.

Psychological Benefits of Frugality

Frugality also brings powerful psychological benefits:

Empowerment. Knowing you can live well on less builds confidence and resilience.

Security. Stretching money gives peace of mind, especially in uncertain times.

Creativity. Finding ways to reuse, repurpose, or DIY fosters resourcefulness and pride.

In essence, frugality shifts the focus from what you own to how well you manage resources.

How to Choose the Right Mindset for You

The real question isn’t whether minimalism or frugality is “better.” It’s: Which mindset supports the life I want?

Ask yourself:

Do I crave peace and clarity more than financial security? → Minimalism may fit better.

Do I crave savings and safety more than simplicity? → Frugality may fit better.

Do I want both? → Blend the two in ways that support your current goals.

For example, you might use minimalism to shape your wardrobe (fewer, higher-quality pieces) while using frugality for groceries (meal planning and cooking at home).

Closing Thoughts

Minimalism and frugality may look similar on the surface—both avoid excess, both resist consumerism, both can save you money. But dig deeper, and you’ll see their motivations are worlds apart.

Minimalism is about freedom and meaning.

Frugality is about security and savings.

By understanding the psychology behind each, you can choose (or combine) the mindset that empowers your financial journey. Because in the end, money isn’t just about numbers—it’s about how those numbers make you feel.

Comments