Escaping the FOMO Trap: A Minimalist Path to Financial Freedom

- jennifercorkum

- Oct 7

- 2 min read

Introduction: The Subtle Grip of FOMO

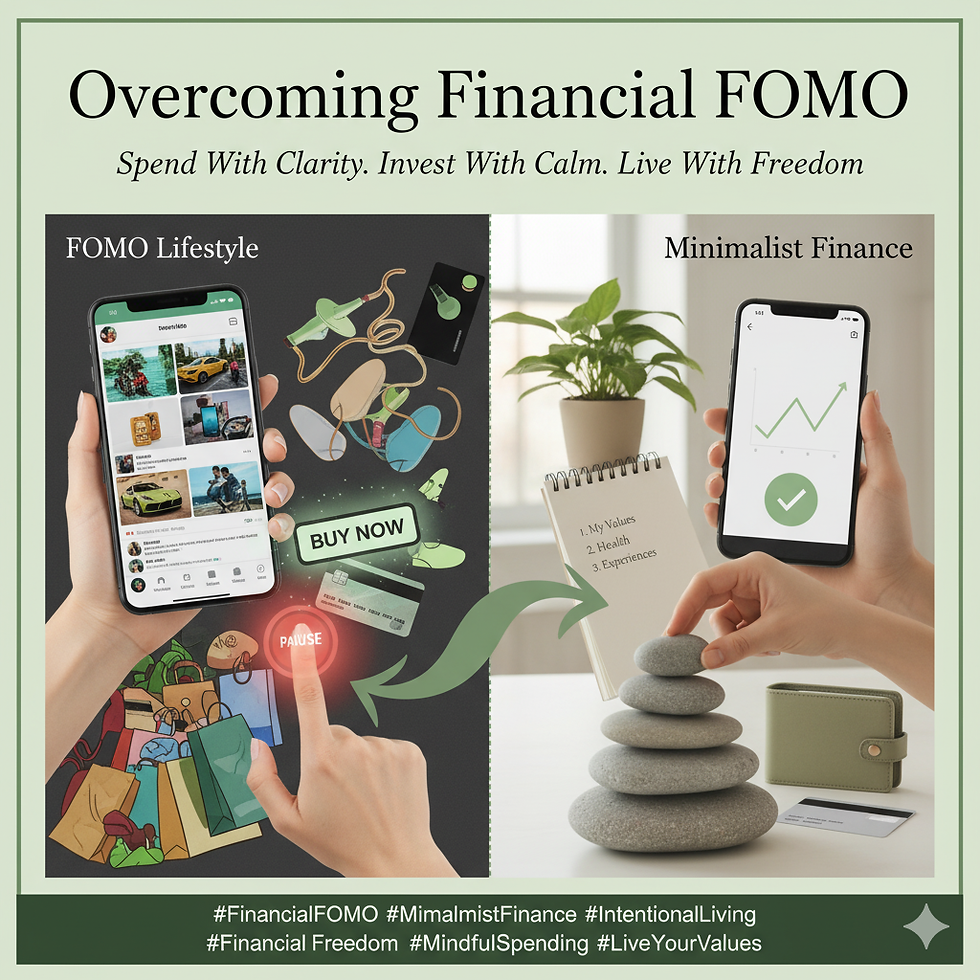

In today’s hyperconnected world, comparison is constant. A quick scroll through social media reveals highlight reels—friends traveling abroad, entrepreneurs flashing new cars, influencers promoting the latest gadgets. Each glimpse fuels the fear of missing out (FOMO): the nagging sense that if you’re not keeping up, you’re falling behind.

But here’s the paradox: chasing every opportunity, trend, or lifestyle upgrade doesn’t actually make us richer—it drains our wallets and peace of mind. Through the lens of minimalist finance, overcoming FOMO isn’t about deprivation. It’s about freedom, clarity, and control.

The Hidden Financial Cost of FOMO

When we let FOMO drive decisions, the results often look like this:

Impulse Spending: Buying things we never planned for—just to “fit in.”

Debt Accumulation: Financing lifestyles that exceed our income.

Investment Hype: Jumping into risky assets because “everyone else is cashing in.”

These habits not only sabotage financial stability but also create cycles of stress and regret. Minimalist finance asks the hard question: Does this expense serve my long-term goals, or am I just serving the illusion of status?

The Minimalist Shift: From Scarcity to Enough

At its core, FOMO comes from a scarcity mindset—the fear that opportunities are limited, and we must grab everything before it’s gone. Minimalist finance offers a counterbalance: the belief in enough.

Scarcity Mindset: “If I don’t buy now, I’ll never catch up.”

Enough Mindset: “What I already have supports my goals. I don’t need to compete.”

This subtle shift transforms financial behavior. When “enough” becomes the benchmark, FOMO loses its grip.

5 Minimalist Strategies to Beat Financial FOMO

1. Curate Your Inputs

If your Instagram feed makes you feel behind, change it. Follow voices that promote intentional living, not consumerism. Protect your mental space from triggers.

2. Apply the 72-Hour Rule

Before making non-essential purchases, wait three days. Most “urgent” buys lose their appeal once the initial emotional rush fades.

3. Reframe Investing

Skip the hype. Instead of chasing the latest hot stock or crypto, focus on simple, diversified strategies like low-cost index funds. Boring, steady investing wins the race.

4. Spend Based on Values, Not Validation

Ask yourself: Does this expense align with my vision of financial independence, or am I paying for appearances? If it’s the latter, let it go.

5. Keep an Abundance Journal

List what you already have—skills, relationships, savings, opportunities. Practicing gratitude reframes your financial perspective and weakens FOMO at its root.

Minimalism, Money, and Mental Health

Financial decisions aren’t just about numbers—they’re emotional. FOMO amplifies anxiety and creates identity crises. Minimalism, however, strips away the noise, reminding us that our worth isn’t tied to possessions.

The result? Lower stress, more focus, and a sense of grounded confidence that no purchase can buy.

Conclusion: Choosing Purpose Over Pressure

Overcoming FOMO through minimalist finance isn’t about missing out—it’s about opting out of distractions that don’t serve your values. By rejecting the cycle of comparison, you gain something more valuable than the latest gadget or trend: control over your time, money, and peace of mind.

When you realize that enough is truly enough, FOMO no longer controls you. That’s where financial freedom begins.

Comments