Value-Driven Spending: How Minimalism Can Transform Your Financial Life

- jennifercorkum

- Oct 27, 2025

- 5 min read

Stop chasing “more.” Start funding what matters.

Introduction: When Spending Doesn’t Match Living

Have you ever looked at your bank statement and thought, “Where did all my money go?”

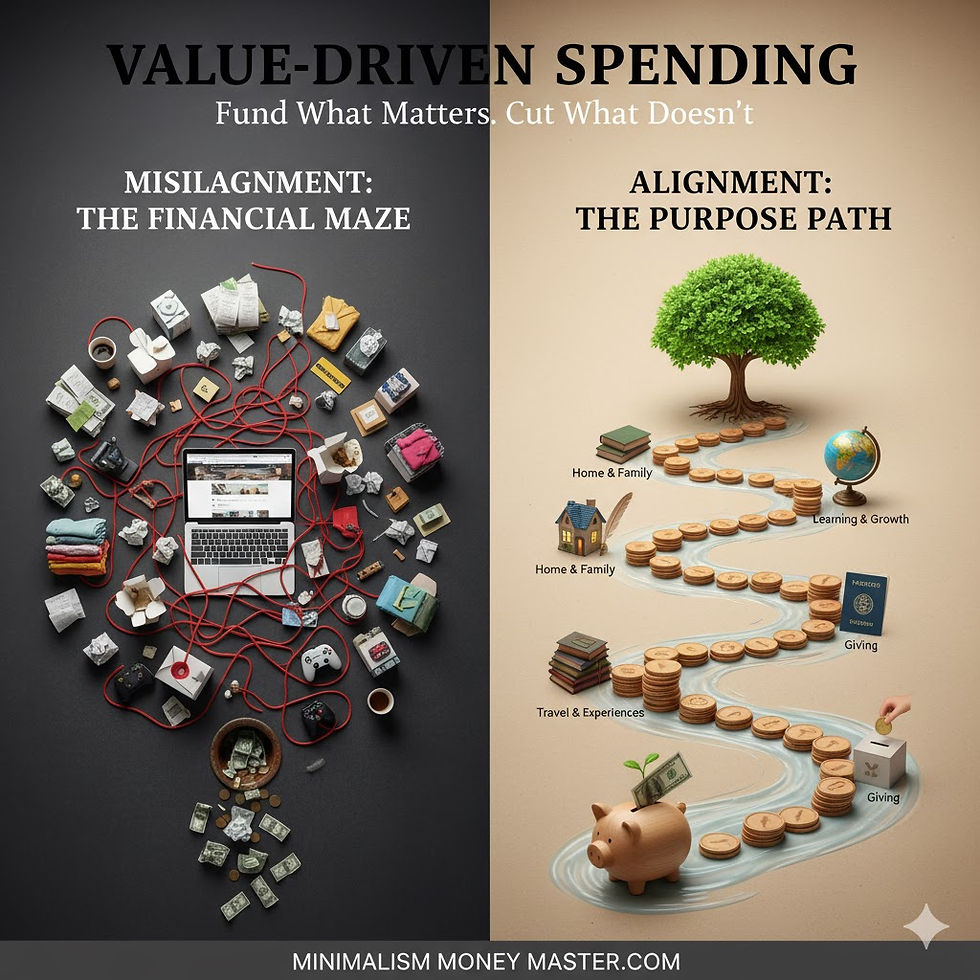

For many people, the issue isn’t a lack of income — it’s a lack of alignment. We spend on things that don’t bring lasting fulfillment while underfunding the areas of life that truly matter to us. Over time, this misalignment creates financial stress, cluttered lives, and a subtle but persistent feeling of dissatisfaction.

The good news? You can change this. By practicing value-driven spending, a core principle of minimalist finance, you can realign your money with your priorities — creating a financial life that supports your ideal lifestyle instead of working against it.

This is not about cutting everything fun out of your life. It’s about spending less on what doesn’t matter, so you can invest more in what does.

1. Start With Radical Clarity

The first step toward aligning spending with your values is to get radically clear on what those values actually are. Without this foundation, even the best budgeting app or financial strategy won’t give you real satisfaction — because you’ll still be chasing goals that aren’t truly yours.

Take 10 quiet minutes with a journal or blank document and ask yourself:

What experiences or achievements give my life meaning?

When have I felt the most fulfilled?

If I stripped away all external expectations, what would I focus on?

What do I want my life to look like in 5–10 years?

Write down your top 3–5 core values. Examples might include:

Freedom and independence

Family and relationships

Health and vitality

Lifelong learning

Creativity and contribution

Travel and adventure

📝 Minimalist finance principle: Values are the blueprint; money is the building material. Without a blueprint, even well-managed money can build the wrong house.

2. Shine a Light on the Numbers

Once you’ve defined your values, it’s time to confront your current spending reality. This is often the most uncomfortable — but most transformative — part of the process.

Pull 3–6 months of bank and credit card statements. Categorize your spending into broad areas such as:

Housing & utilities

Food & dining

Transportation

Shopping & personal spending

Subscriptions & entertainment

Travel & experiences

Debt payments

Savings & investments

Now, for each category, compare spending to your values:

If “health” is a core value but 80% of your food budget goes to fast food and takeout, there’s a gap.

If “freedom” is a priority but 40% of your income is locked up in debt for unused items, there’s a gap.

If “travel” matters but all your disposable income vanishes into online shopping, there’s a gap.

Awareness precedes alignment. You can’t redirect your financial life until you see it clearly.

3. Identify and Cut the Non-Essentials

Minimalism is not about cutting for the sake of cutting — it’s about eliminating the noise to make space for what matters.

Go through your spending categories and identify non-essential expenses that don’t align with your core values. Common examples include:

Impulse online purchases that sit unused

Multiple streaming subscriptions you rarely watch

“Status” upgrades that don’t increase daily happiness

Habitual spending that’s more about convenience than joy

This doesn’t mean you have to live ascetically or cancel everything you enjoy. It means you intentionally cut expenses that don’t add value, so that your spending reflects your priorities, not your impulses.

💡 Every unnecessary expense is a silent vote for a life you don’t actually want.

4. Redirect Intentionally

Once you’ve freed up money by cutting the non-essentials, redirect it toward your values. This is where value-driven spending comes alive.

For example:

Cut $300/month of random shopping and allocate it to a travel fund, allowing for meaningful experiences instead of clutter.

Cancel unused subscriptions and increase your retirement contributions, aligning with long-term security.

Reduce dining out and put that money toward a gym membership or nutrition program, if health is a priority.

Reallocate luxury splurges toward charitable giving or causes that matter to you.

When your spending reflects your values, every dollar works for you, not against you.

And here’s the powerful part: small, consistent reallocations compound over time. Cutting $300/month in misaligned spending and investing it could grow to over $50,000 in 10 years (assuming a 7% annual return). That’s the difference between unconscious spending and intentional wealth-building.

5. Automate Your Values

Human willpower is finite. Even when our intentions are good, habits can pull us off track. That’s why automation is a minimalist finance superpower.

Set up systems so your value-aligned decisions happen by default:

Automate transfers to savings, investments, or designated “value funds” like travel or giving.

Schedule recurring donations to organizations that reflect your values.

Use budgeting apps to categorize spending automatically and flag misalignments.

Automation turns your values into financial habits, not occasional resolutions. Instead of constantly deciding, you set the structure once — and let it work in the background.

6. Revisit Regularly

Values evolve over time. What matters most in your 20s may not be the same in your 40s. That’s why value-driven spending isn’t a “set it and forget it” exercise — it’s a recurring minimalist practice.

Every 6–12 months:

Reaffirm your top values.

Review spending patterns for alignment.

Identify any new “value leaks” that have crept in.

Adjust your budget and automation to reflect current priorities.

Think of it like financial decluttering. Just as a minimalist home requires occasional maintenance, a values-aligned financial life benefits from regular check-ins.

7. The Minimalist Advantage

When you align spending with values through a minimalist lens, you unlock both financial and emotional advantages:

Financial Benefits:

💰 Less waste and more savings

🚀 Faster progress toward meaningful goals

📈 Greater financial resilience due to intentional allocation

Emotional Benefits:

🧠 Less guilt and regret about spending

✨ More clarity and confidence in your financial decisions

❤️ A deeper sense that your money is building the life you actually want

This is what sets minimalist finance apart from traditional budgeting. Instead of simply tracking and limiting spending, you’re strategically designing your financial life to reflect who you are.

8. Overcoming Common Obstacles

Shifting to value-driven spending can feel uncomfortable at first. You might face:

Social pressure to maintain appearances

FOMO when cutting back on trendy purchases

Emotional habits like stress shopping or convenience spending

The key is to remember: you’re not depriving yourself — you’re choosing differently. When you spend based on values, the temporary discomfort of cutting noise is outweighed by the lasting fulfillment of alignment.

Surround yourself with like-minded people, limit exposure to consumerist triggers (like endless “haul” videos), and remind yourself why this matters: freedom, clarity, purpose.

Conclusion: Spend Like Your Life Depends On It

Because in many ways, it does.

When your spending aligns with your values, your money stops working against you and starts working for you. You’re no longer a passive participant in your financial story — you’re the author.

Value-driven spending is the bridge between minimalist principles and financial freedom. It’s not about living with less for the sake of it; it’s about living with intention. When you focus your resources on what truly matters, you build wealth, reduce stress, and craft a life that actually reflects your priorities.

You don’t need to overhaul everything overnight. Start small. Clarify your values. Audit your spending. Make one meaningful shift this month. Over time, these changes compound — both financially and emotionally.

Spend like your life depends on it. Because the life you want is built, one intentional dollar at a time.

Comments