Tiny Home Buying on a Budget: A Minimalist Finance Guide to Simplify Your Life

- jennifercorkum

- Aug 25, 2025

- 3 min read

Thinking about going tiny? Discover how to buy a tiny home while sticking to a minimalist finance budget. Save money, reduce debt, and live intentionally.

Tiny Home Buying on a Minimalist Finance Budget: A Complete Guide 🏡🌿

In today’s fast-paced, consumer-driven world, more people are seeking simplicity, financial freedom, and intentional living. One growing trend that embodies all three is the tiny home movement.

Whether you’re dreaming of downsizing, reducing your financial stress, or living a more eco-friendly lifestyle, buying a tiny home can be a powerful step toward achieving minimalist living. However, to make it work, you need a plan that aligns with minimalist finance principles: spend less, avoid unnecessary debt, and focus on what truly matters.

In this guide, we’ll break down how to buy a tiny home with a minimalist budget — so you can create a life filled with freedom, purpose, and sustainability.

Why Tiny Homes Are Perfect for a Minimalist Finance Lifestyle 🌱

Tiny homes are more than just cute, Instagram-worthy houses. They represent a mindset shift: living intentionally and focusing on value over volume.

Key Benefits of Tiny Home Living

Lower housing costs → Smaller mortgages or even no mortgage at all

Less financial stress → Fewer bills, less maintenance, and reduced clutter

Eco-friendly lifestyle → Less space = less energy consumption

Freedom to prioritize experiences → Spend on what truly matters instead of “stuff”

If your goal is to simplify your life and finances, a tiny home offers the perfect balance of affordability and intentionality.

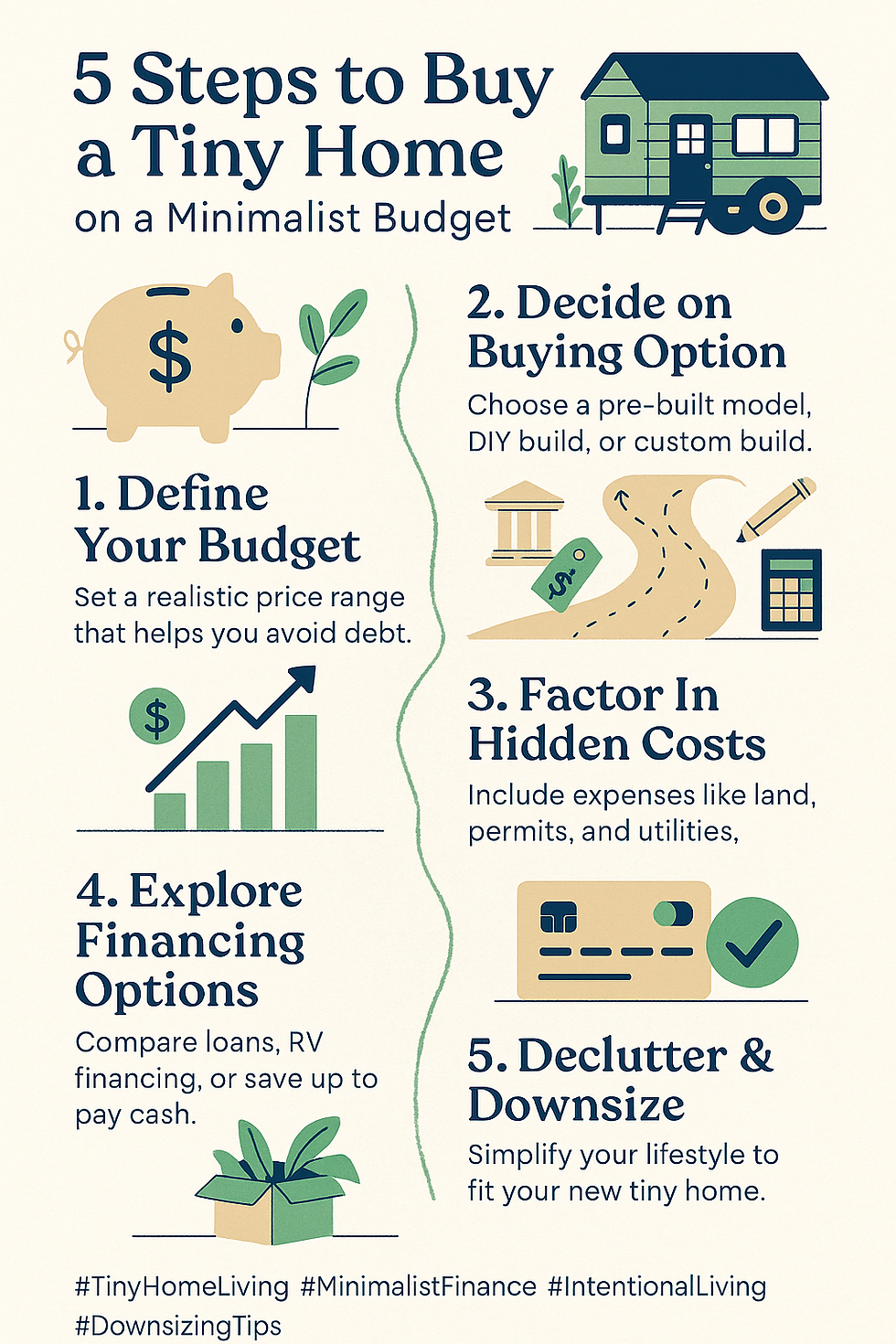

Step 1: Define Your Budget Before You Shop 💰

Before browsing floor plans or watching HGTV marathons, take a step back and set a realistic budget based on minimalist finance principles.

Questions to Ask Yourself

How much can I afford without going into unmanageable debt?

Am I paying cash, or will I need financing?

How does this purchase align with my long-term financial goals?

Pro Tip: Aim to spend less than 25–30% of your total income on housing costs, including utilities, insurance, and property taxes.

For many tiny homeowners, saving up and paying cash is ideal. It allows you to avoid monthly mortgage payments and live completely debt-free — a core principle of minimalist finance.

Step 2: Choose Between Pre-Built, DIY, or Custom-Built 🏠

When it comes to buying a tiny home, you generally have three main options:

1. Pre-Built Tiny Homes

Cost: $40,000–$80,000 on average

Pros: Move-in ready, minimal effort, financing options available

Cons: Less customization, potentially higher upfront costs

2. DIY Tiny Home Builds

Cost: $10,000–$40,000 depending on materials and size

Pros: Cheapest route, fully customizable, rewarding process

Cons: Time-consuming, requires building skills, unexpected expenses

3. Custom-Built Tiny Homes

Cost: $50,000–$100,000+

Pros: Tailored to your lifestyle, energy-efficient, higher-quality finishes

Cons: Higher costs, longer timelines

Minimalist Tip: Choose the option that aligns best with both your budget and values. Avoid overspending on features you don’t actually need.

Step 3: Factor in Hidden Costs 🧾

Buying a tiny home isn’t just about the sticker price. To avoid financial surprises, consider these additional expenses:

Land Costs: Do you already own property, or will you lease/rent a plot?

Permits & Zoning Fees: Check local regulations before buying.

Utilities: Solar panels, composting toilets, water hookups, etc.

Transportation: If your tiny home is mobile, factor in towing costs.

Insurance: Protect your investment from damage and liability.

Minimalist finance is all about planning ahead so your new lifestyle doesn’t come with unexpected debt.

Step 4: Streamline Financing the Minimalist Way 💳

If paying cash isn’t possible, you’ll need to explore affordable financing options:

Personal Loans → Easier to obtain but may come with higher interest

RV Loans → Ideal for tiny homes on wheels

Tiny Home-Specific Lenders → Niche companies are now offering financing designed for tiny living

Savings + Side Hustles → Combine partial financing with extra income to minimize total debt

Pro Tip: Stick to minimalist finance principles: borrow less than you qualify for and focus on paying it off as quickly as possible.

Step 5: Embrace Intentional Living ✨

Buying a tiny home isn’t just a financial decision — it’s a lifestyle shift. Before you move in, spend time decluttering your belongings and simplifying your expenses.

Declutter ruthlessly: Only keep items that bring value or joy

Downsize your subscriptions and services

Set up automated savings to build your emergency fund

Stick to a minimalist budget to avoid lifestyle creep

Remember: the goal isn’t just a smaller home; it’s more freedom, less stress, and a clearer path to financial independence.

Comments