The Minimalist Credit Card Strategy — Why Less Is More

- jennifercorkum

- Sep 25, 2025

- 3 min read

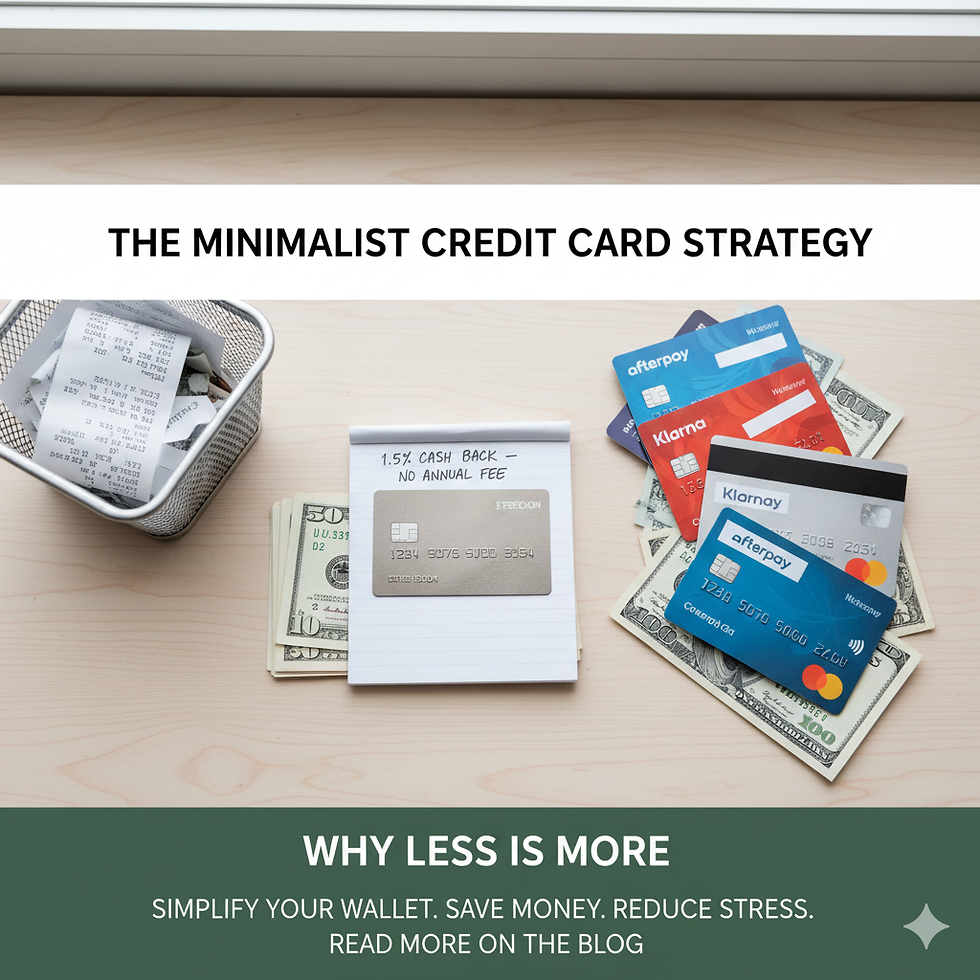

Credit cards can be powerful tools. They offer convenience, fraud protection, rewards, and the ability to build credit. But in today’s consumer culture, it’s easy to get overwhelmed. Points and perks lure us into juggling multiple cards, annual fees pile up, and financial clutter creeps in.

From a minimalist finance perspective, the question is simple: Do you really need more than one credit card? For most people, the answer is no. Minimalism teaches us that less is more — and that includes credit cards.

The Problem With Credit Card Clutter

Having multiple credit cards isn’t inherently bad, but it often creates more problems than benefits.

Overspending: When every card offers a different reward structure, it becomes tempting to buy more just to “earn points.”

Missed Payments: Managing several due dates increases the chance of late fees and credit score dings.

Annual Fees: Premium cards often charge $95–$500 per year — and many users never fully recoup the cost.

Mental Clutter: Tracking balances, payments, and rewards across multiple accounts drains mental energy.

The result? Instead of simplifying your financial life, credit cards often complicate it.

Minimalism Applied to Credit Cards

Minimalism is about living intentionally. Instead of asking How many credit cards can I manage? the better question is: How many do I actually need to achieve my goals?

For most people, one well-chosen credit card is enough. Here’s why:

Simplicity: One card = one due date, one balance to track, one set of rewards to understand.

Clarity: You always know where your spending is, which makes budgeting easier.

Control: With fewer moving parts, you’re less likely to overspend or miss payments.

Minimalism isn’t about deprivation. It’s about aligning your financial tools with your life — not letting them control you.

The Case for One Card

A single, versatile credit card can cover all your bases:

Rewards: A flat-rate cashback card (e.g., 1.5% or 2% back on everything) keeps things simple without chasing categories.

No Annual Fee: Many cards offer strong rewards with no annual cost.

Fraud Protection: Credit cards often provide better fraud protection than debit cards.

Credit Building: Paying one card in full each month helps you build and maintain a strong credit score.

By choosing one card wisely, you gain all the benefits of credit without the clutter.

But Don’t I Need More Than One?

This is where consumer culture kicks in: more is always better, right? Not necessarily.

Travel Perks: If you’re a frequent traveler, one premium travel card might make sense — but if you’re not, those perks often go unused.

Balance Transfers: A second card can be useful for debt consolidation. But once the debt is gone, you don’t need to keep collecting new cards.

Emergency Backup: Some prefer a backup card, but a debit card or emergency fund often provides the same security without the clutter.

Minimalism asks: Is the benefit worth the complexity? Often, it isn’t.

Financial Benefits of a Minimalist Credit Card Strategy

Cutting back to one credit card simplifies more than your wallet — it also strengthens your finances.

Save on Fees: Avoid paying annual fees for cards you don’t fully use.

Avoid Overspending: Without juggling reward categories, you focus on intentional purchases.

Strengthen Budgeting: One card makes it easy to track where your money goes each month.

Improve Credit Health: On-time payments and low balances on one card can boost your score without extra accounts.

Every unnecessary card closed is one less financial leak in your budget.

Practical Steps to Simplify Your Credit Cards

Audit Your Cards: List every card you own, including annual fees, rewards, and balances.

Evaluate Value: Ask yourself if each card truly adds value to your financial life.

Choose One Keeper: Keep the card with the best balance of rewards, no annual fee, and simplicity.

Close or Downgrade the Rest: Thank them for their service, then simplify.

Automate Payments: Set up autopay on your one card to avoid missed payments.

This process mirrors decluttering your home: keep what serves you, release what doesn’t.

Final Thoughts: Less Really Is More

Credit cards are tools — not trophies. The goal isn’t to collect as many as possible, but to use them wisely. From a minimalist finance perspective, one well-chosen card can provide all the benefits you need while keeping your financial life simple, clear, and stress-free.

The truth is simple: fewer credit cards mean fewer fees, fewer temptations, and fewer headaches. When it comes to credit card strategy, less really is more.

Comments