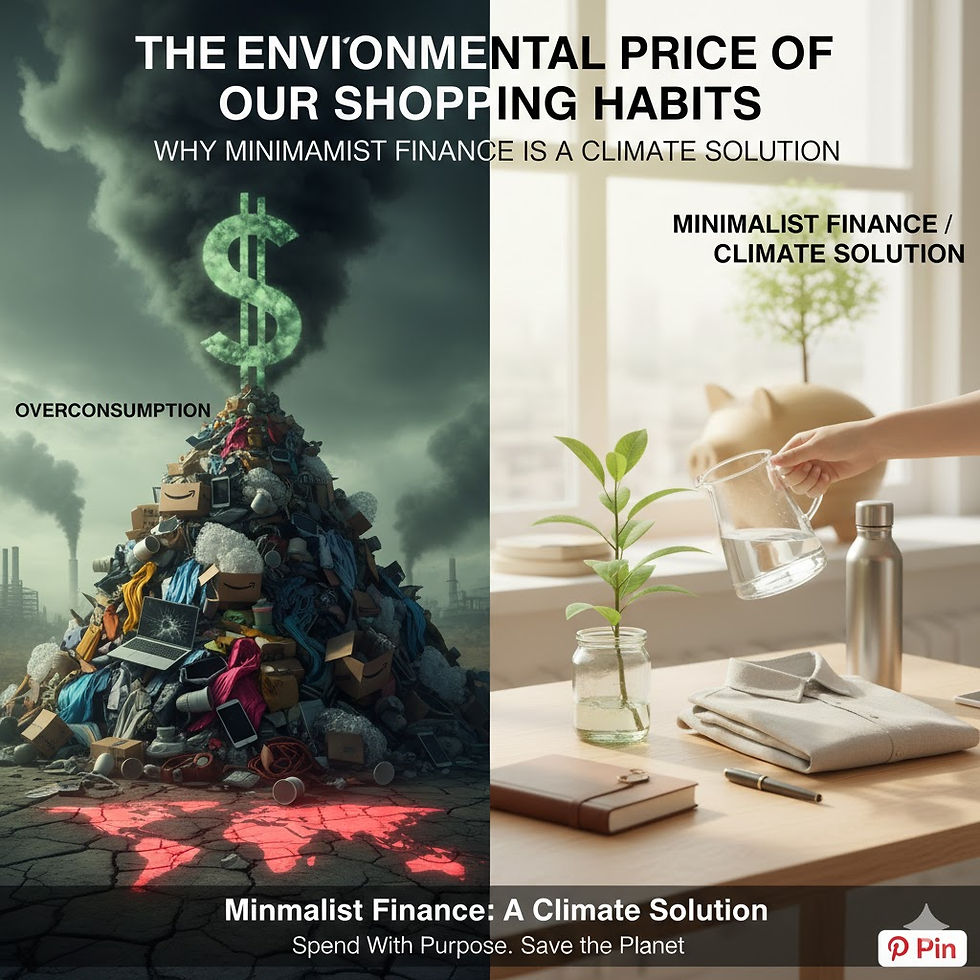

The Environmental Price of Our Shopping Habits — Why Minimalist Finance Is a Climate Solution

- jennifercorkum

- Oct 23, 2025

- 5 min read

Every purchase we make is more than a swipe of a card — it’s a statement. It’s a financial decision and an environmental one.

Behind every T-shirt, smartphone, or piece of home décor is a long, often invisible chain of water use, carbon emissions, resource extraction, labor, shipping, and eventual waste. Our culture of overconsumption has turned shopping into a reflex, but that reflex comes at a high cost — both to our wallets and to the planet.

The good news? Shifting toward a minimalist finance mindset — buying less, choosing better, and valuing longevity over novelty — offers one of the most practical ways to reduce environmental impact and improve financial resilience.

The Hidden Lifecycle of Stuff

Let’s start with something simple: a cotton T-shirt.

At the store, it costs maybe $10. But its true lifecycle cost looks like this:

Over 700 gallons of water are used to produce a single cotton T-shirt — that’s what one person drinks in almost three years.

Cotton cultivation often involves heavy pesticide use, degrading soil and harming ecosystems.

Manufacturing requires energy, often from fossil fuels.

International shipping burns through fuel, contributing to global emissions.

And after a handful of wears, many of these shirts end up in landfills or incinerators.

The environmental story behind that T-shirt is repeated across nearly every consumer product we buy. Whether it’s fast fashion, gadgets, or home goods, each item requires raw materials, labor, transportation, and eventually disposal.

When we consume more than we need, we amplify that entire chain of impact — often for things that bring us only temporary satisfaction.

SEO keywords: environmental impact of shopping, minimalist finance, sustainable minimalism, overconsumption and climate, eco-friendly lifestyle.

Fast Fashion: Cheap for Us, Costly for the Planet

No industry embodies overconsumption better than fast fashion.

Fast fashion brands built their empires on speed and volume: releasing new styles weekly, producing clothing cheaply, and encouraging consumers to buy more, more often. What used to be seasonal collections are now micro-trends that last mere weeks.

The hidden environmental costs are alarming:

The fashion industry accounts for 8–10% of global carbon emissions — more than aviation and shipping combined.

It’s responsible for roughly 20% of global wastewater, thanks to intensive dyeing and finishing processes.

Synthetic fabrics like polyester shed microplastics with every wash, polluting rivers and oceans.

Financially, fast fashion creates a false sense of “saving.” Low prices encourage frequent purchases that add up silently. Ten “cheap” items at $20 each is still $200 — and often, these items wear out quickly or go unused.

Minimalist finance takes the opposite approach: buy fewer, higher-quality pieces that last longer. Over time, this reduces both environmental impact and financial waste.

Electronics and the E-Waste Tsunami

It’s not just clothing. Our appetite for electronics has created a growing environmental crisis: e-waste.

Smartphones are replaced on average every 2–3 years, often not because they’re broken, but because a new model launches. Laptops, TVs, kitchen gadgets, and appliances follow similar cycles. Planned obsolescence — products designed to have short lifespans or be difficult to repair — accelerates this problem.

The numbers are staggering:

The world generates over 50 million metric tons of e-waste each year.

Less than 20% is formally recycled.

Much of it ends up in developing countries, where informal recycling exposes workers to toxic materials like lead and mercury.

From a financial standpoint, frequent tech upgrades quietly erode wealth. Spending $1,000 on a new phone every two years is not just $500 a year — it’s lost investment potential and an entrenched habit of default upgrading.

Minimalist finance encourages consumers to extend product lifespans, repair when possible, and resist marketing-driven upgrades. These choices are as good for the planet as they are for your budget.

The Shipping and Packaging Footprint

Online shopping has made consumption faster and easier than ever — but it has also added a new layer of environmental impact.

Each package involves:

Multiple layers of plastic, cardboard, and fillers.

Transportation emissions from warehouses to sorting hubs to delivery vans.

Often, inefficient logistics, like shipping single items separately.

Returned products that are frequently discarded rather than resold, because processing returns is expensive.

Expedited shipping, in particular, dramatically increases emissions. Instead of consolidating shipments, companies prioritize speed, often flying items across the country to meet delivery guarantees.

This doesn’t mean we should never shop online. But by ordering less frequently, avoiding unnecessary returns, and choosing slower shipping, we can significantly shrink this part of our environmental footprint — while simplifying our spending habits.

How Minimalist Spending Supports the Planet

One of the most overlooked environmental strategies is also one of the simplest: buy less.

Minimalist finance and sustainability intersect beautifully. Here’s how:

1. Buy Less, Use Longer

The greenest product is the one you already own. Extending the lifespan of clothes, electronics, and home goods reduces both financial outflow and environmental input.

2. Choose Quality Over Quantity

Well-made items last longer and often have lower lifetime costs than cheap, disposable alternatives. A single high-quality coat can replace years of fast fashion cycles.

3. Repair, Don’t Replace

Repair culture is both empowering and sustainable. Whether it’s sewing a button, fixing a laptop battery, or refinishing a table, repair keeps items in circulation longer and reduces waste.

4. Buy Secondhand or Borrow

Thrift stores, online marketplaces, and lending communities allow you to reuse existing resources instead of creating new demand. This saves money and drastically cuts environmental impact.

5. Declutter Responsibly

Minimalism isn’t about throwing everything away — it’s about thoughtful curation. Donate, recycle, or sell items to keep them in use rather than in landfills.

When we spend intentionally, we consume fewer resources, produce less waste, and spend less money. It’s a win for your budget and for the planet.

A Mindset Shift: From Consumers to Stewards

For decades, marketing has trained us to see ourselves primarily as consumers. Our role, we’re told, is to buy, upgrade, repeat. But this mindset is neither financially sustainable nor environmentally viable.

Minimalist finance encourages a stewardship mindset instead: using money deliberately to support a meaningful, sustainable life.

When we ask “Do I really need this?” instead of “Can I afford this?”, we reclaim power over both our finances and our impact. We stop being passive participants in overconsumption and start shaping the world through conscious choices.

A Real-Life Example: The Intentional Household

Consider a family that decides to adopt minimalist financial principles with sustainability in mind.

They commit to no new clothing purchases for a year, except to replace worn-out essentials.

They repair appliances instead of replacing them at the first sign of trouble.

They shift from trendy décor to timeless, durable pieces.

They consolidate online orders and avoid express shipping.

They buy used electronics when upgrading and keep devices longer.

Within two years, their household spending drops by thousands, their waste output decreases, and their home feels calmer and less cluttered. More importantly, they align their financial goals with their environmental values — a synergy that makes both stick.

Minimalist Finance as Climate Action

When we talk about solving the climate crisis, the conversation often centers on policy or technology — both critical pieces. But individual consumption habits, especially in wealthier societies, play a huge role too.

Minimalist finance represents a climate solution hiding in plain sight. By consuming less and better, we:

Lower our carbon footprint.

Reduce waste streams.

Free up financial resources for meaningful goals.

Model sustainable living for our communities.

It’s not about perfection — no one can opt out of consumption entirely. But even moderate changes, when multiplied by millions of people, have transformative power.

Final Thoughts

Every shopping decision is both a financial and environmental act. Overconsumption has hidden costs that go far beyond our bank statements, but the solution isn’t complicated: consume less, choose well, and use longer.

Minimalist finance is not only a path to personal freedom — it’s a powerful, practical climate strategy. By aligning our spending with our values and the planet’s limits, we can build a future that’s both sustainable and financially secure.

Your money is a vote. Spend it like it matters — because it does.

Comments