Minimalist Alternatives to Buy Now, Pay Later: How to Shop With Intention

- jennifercorkum

- Sep 23, 2025

- 4 min read

“Buy Now, Pay Later” (BNPL) is marketed as financial freedom. Four easy payments, no interest, instant access. But as we’ve explored in this series, the reality is different: BNPL creates clutter, encourages overspending, and traps you in micro-debt.

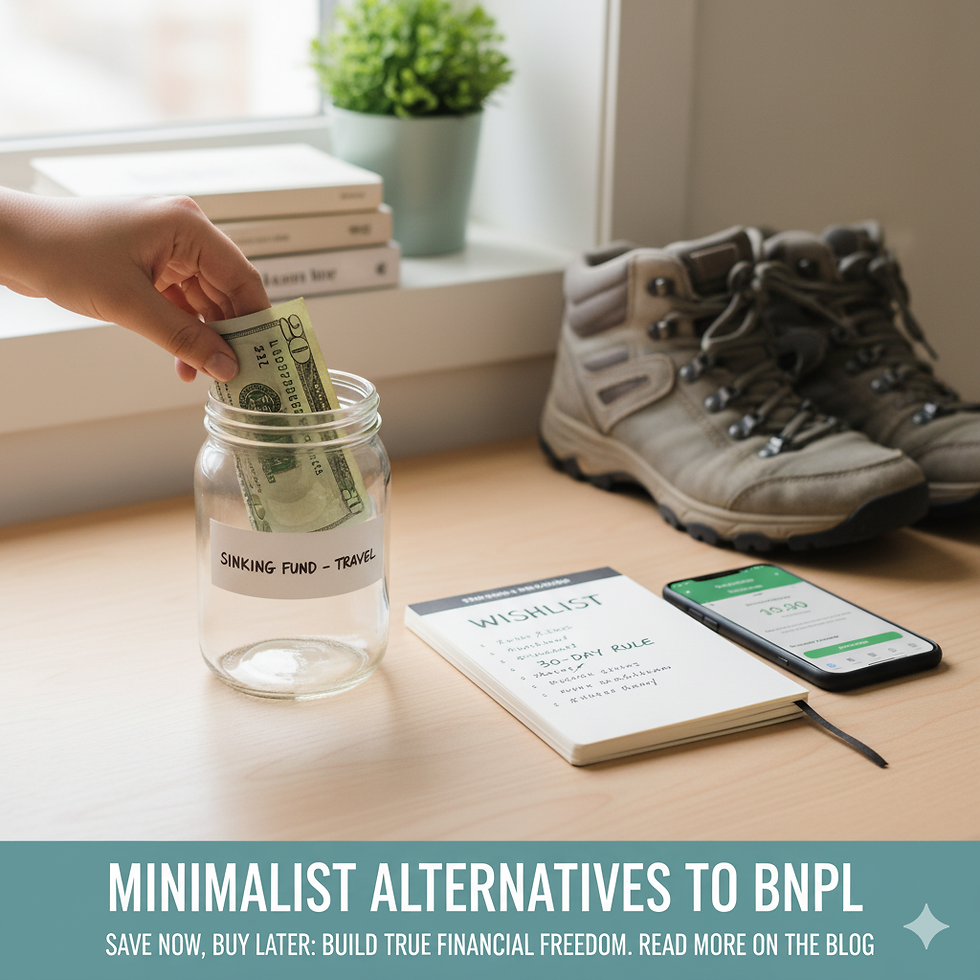

From a minimalist finance perspective, the solution isn’t just canceling BNPL. It’s building intentional shopping habits that eliminate the need for BNPL in the first place. Let’s explore practical, minimalist alternatives that help you save money, reduce stress, and align your spending with your values.

Why We Fall Into the BNPL Trap

Before we look at alternatives, it’s worth asking: Why do people rely on BNPL?

Instant gratification — We want the product now, even if we can’t afford it.

Price illusion — Breaking a $200 item into four payments of $50 feels smaller.

Budget struggles — Without savings or a cushion, BNPL feels like the only option.

Marketing pressure — Retailers aggressively push BNPL at checkout, making it look normal.

Minimalism teaches us to pause, step back, and ask: Do I really need this — and do I need it right now?

Minimalist Alternative #1: The 30-Day Rule

The simplest way to avoid BNPL is to delay your purchase. If you want something non-essential, wait 30 days before buying.

If you forget about it after 30 days, it wasn’t important.

If you still want it, and can pay in full, then it’s a conscious choice.

This rule replaces impulsive “buy now” habits with mindful, intentional decisions.

Minimalist Alternative #2: Cash-Only Purchases

A core minimalist finance principle: If you can’t pay cash, you can’t afford it.

Paying in cash (or from checking, not credit) forces you to confront the real price. No installments, no tricks. It also protects you from future obligations hanging over your budget.

Try setting a “cash-only” rule for wants, not just needs. You’ll instantly reduce the temptation to overspend.

Minimalist Alternative #3: Sinking Funds for Wants

Instead of financing items with BNPL, create a sinking fund — a small savings account for discretionary purchases.

Set aside $20–$50/month into this fund.

When you want something, buy it only if the fund covers it.

No debt, no guilt, no clutter.

This method flips BNPL on its head: instead of borrowing from your future self, you save with your present self.

Minimalist Alternative #4: Intentional Wishlists

BNPL thrives on urgency — “Get it now, pay later.” A minimalist alternative is the intentional wishlist.

Create a running list of things you want.

Review it monthly.

Buy only what still feels necessary, valuable, and affordable in full.

You’ll be surprised how many wants fade with time.

Minimalist Alternative #5: Focus on Experiences, Not Things

BNPL pushes physical goods — clothes, gadgets, accessories. But minimalism reminds us that experiences often bring more joy than stuff.

Instead of financing the latest shoes, redirect that money into:

A day trip with friends.

A class that builds a skill.

Savings for travel or family experiences.

Experiences enrich your life without adding clutter — and they don’t require monthly payments.

Minimalist Alternative #6: Build a Financial Cushion

At its root, BNPL often exists because people don’t have savings. A small emergency fund eliminates the need to finance wants and needs.

Start with a goal of $500–$1,000.

Use it for genuine emergencies, not lifestyle upgrades.

As your cushion grows, you’ll never need BNPL again.

Minimalism values security over convenience. A cushion buys you freedom.

Redirecting BNPL Savings Into Freedom

Canceling BNPL isn’t just about avoiding debt — it’s about creating opportunity. Imagine redirecting $100/month away from BNPL payments into:

Investments: Over 10 years at 7% return, that grows to nearly $17,000.

Debt repayment: Accelerating your path to financial independence.

Experiences: Building memories, not clutter.

Minimalist finance reframes money: every dollar you don’t give to BNPL is a dollar you can use to build freedom.

Final Thoughts: Shopping With Intention

BNPL isn’t financial empowerment — it’s consumerism disguised as convenience. But minimalism offers a different path: slowing down, buying consciously, and paying in full.

By adopting habits like the 30-day rule, cash-only spending, sinking funds, and intentional wishlists, you can escape the trap of “buy now, pay later” and embrace “save now, buy later.”

Minimalist finance isn’t about deprivation. It’s about clarity, alignment, and freedom. And when it comes to BNPL, the best alternative isn’t four easy payments — it’s one intentional decision.

Key Takeaways From the Series

BNPL creates financial clutter. Multiple small payments are harder to track than one intentional purchase.

Psychology drives overspending. Companies know how to make payments feel painless, but the costs are real.

Micro-debt adds up fast. What looks like $25 every two weeks often stacks into thousands per year.

Minimalism is the antidote. By slowing down, saving first, and buying with intention, you avoid the trap altogether.

Final Thoughts: Choose Freedom Over Four Payments

BNPL isn’t just about splitting purchases — it’s about splitting your attention, your budget, and ultimately, your freedom. Minimalist finance calls us to unsubscribe from debt-based living and embrace clarity instead.

If you’ve ever been tempted by “four easy payments,” this series is for you. Dive into the posts, audit your habits, and discover how minimalism helps you reclaim both your money and your peace of mind.

Comments