Invest With Intention 🌿 | Value-Aligned Investment Strategies Inspired by Minimalist Finance

- jennifercorkum

- Aug 30, 2025

- 4 min read

Managing money isn’t just about growing wealth. It’s about aligning your financial choices with your personal beliefs, values, and lifestyle. For many of us, traditional investing feels cold, overwhelming, and disconnected from what we care about most.

But here’s the truth: your money is always doing something, even when you’re not paying attention. The question is — is it doing something you believe in?

This is where value-aligned investment strategies come in. Inspired by Minimalist Finance, these approaches let you build wealth intentionally while staying true to your priorities, creating harmony between your finances and your life.

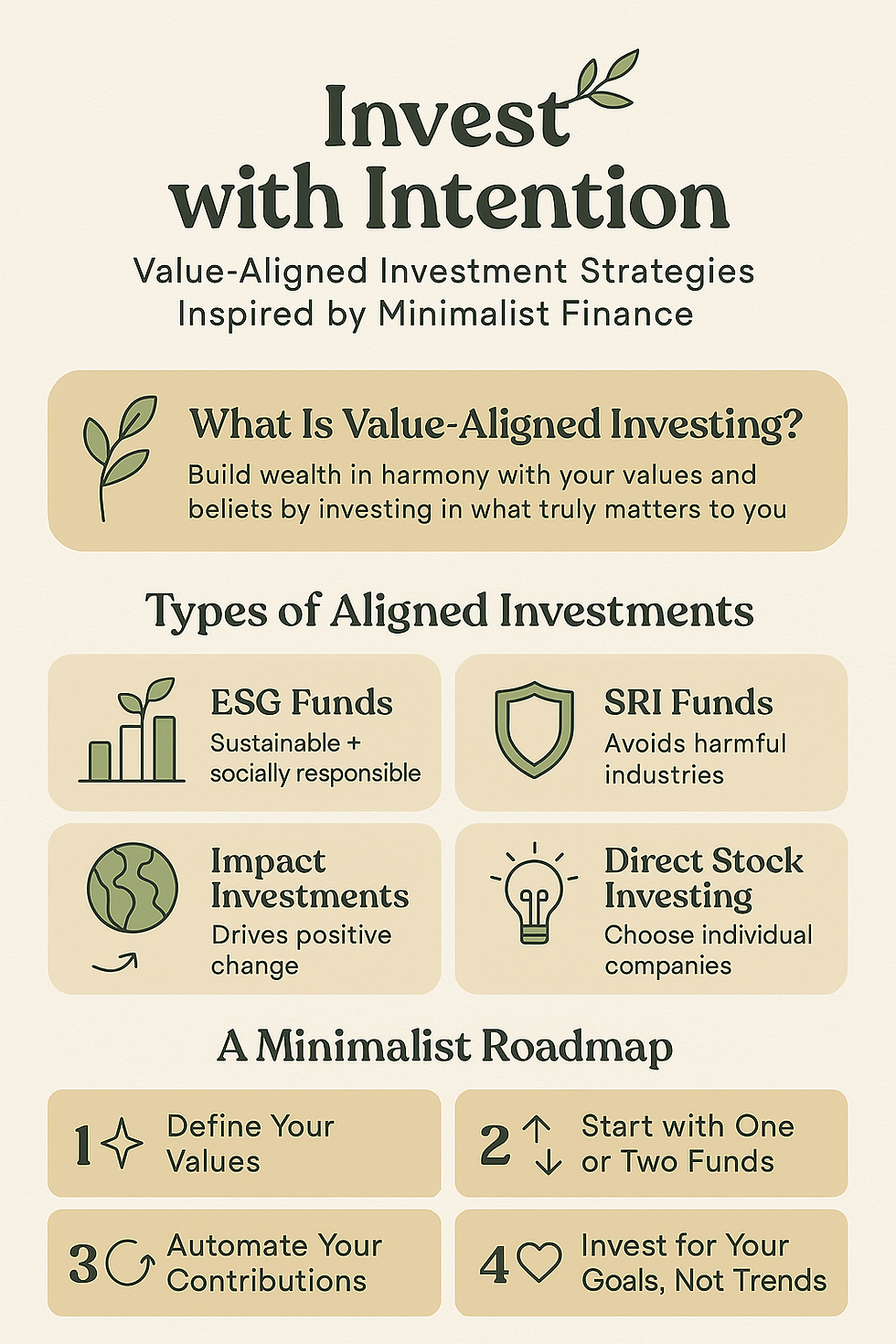

What Is Value-Aligned Investing? 🌱

At its core, value-aligned investing is about putting your money where your heart is. Instead of blindly chasing the highest returns, you invest in companies, funds, and opportunities that reflect your personal values and support your vision of the world.

Here are some examples:

🌿 Sustainability: Invest in green energy ETFs or funds that prioritize environmental impact.

🤝 Social Responsibility: Choose SRI funds that avoid companies with harmful practices (e.g., fossil fuels, tobacco, weapons manufacturing).

⚖️ Diversity & Equality: Look for companies or ETFs that support inclusive leadership and ethical labor practices.

🌍 Community Impact: Focus on local investments or businesses that give back to society.

When your financial goals and personal values are in sync, money becomes more than a tool for wealth. It becomes a way to create positive change while securing your future.

Why Value-Aligned Investing Matters ✨

We live in a world where money shapes everything — policies, industries, even culture. But here’s the thing: you have a say in where your dollars flow.

Traditional investing often leads to a quiet disconnect:

“I want a sustainable world, but my portfolio funds companies harming the planet.”

Minimalist finance flips that script. It invites you to strip away complexity and invest intentionally, so your financial strategy feels peaceful, authentic, and empowering.

Key benefits of value-aligned investing:

✅ Harmony Between Money & ValuesNo more nagging doubts about supporting industries you disagree with.

✅ Emotional Connection to WealthInvesting feels more rewarding when you know your dollars are aligned with your beliefs.

✅ Motivation to Stay the CourseWhen your portfolio reflects your values, you’re less tempted to chase short-term trends.

✅ Resilient, Forward-Thinking GrowthMany ESG and SRI investments focus on long-term sustainability, which often leads to stronger, steadier returns.

Minimalist Finance Meets Value-Aligned Investing 🌿

At Minimalist Finance, the goal isn’t just wealth — it’s clarity, freedom, and intentionality. By focusing on what truly matters and eliminating financial “noise,” you create a portfolio that supports both your lifestyle and your values.

Here’s how to apply a minimalist mindset to investing:

Simplify Your PortfolioSkip the complicated strategies and endless stock-picking. Focus on a handful of value-aligned ETFs or funds that align with your beliefs.

Automate ContributionsSet up automatic transfers into your chosen investments. Minimalism thrives on reducing decisions and letting systems work in the background.

Review Annually, Not DailyAvoid overanalyzing your portfolio. Minimalist investing encourages checking in once or twice a year to ensure your choices still reflect your goals and values.

By keeping your approach simple and intentional, you build peace of mind alongside wealth.

How to Get Started With Value-Aligned Investing 🧩

Starting doesn’t have to be complicated or intimidating. Here’s a step-by-step roadmap:

Step 1: Define What Truly Matters to You 🌟

Grab a notebook and reflect on your personal values:

What causes do I want to actively support?

Are there industries I don’t want to fund?

What kind of world do I want my money to help create?

For example, you might decide:

“I want to support renewable energy, avoid fossil fuels, and prioritize companies that champion equality and fair labor.”

This clarity becomes your investment compass.

Step 2: Explore Value-Aligned Options 📈

There are several investment paths to consider:

ESG Funds (Environmental, Social, Governance) 🌿Invests in companies with sustainable, ethical practices.

SRI Funds (Socially Responsible Investing) 🤝Excludes industries that conflict with your values.

Impact Investments 🌍Directly funds businesses or projects aiming to create positive social or environmental change.

Direct Stock Investing 💡Choose individual companies you believe in — for example, renewable energy firms, ethical tech, or community-driven businesses.

Pro Tip: Use tools like Morningstar’s ESG ratings or Sustainalytics to evaluate whether a fund or company aligns with your values.

Step 3: Start Small and Automate 🌱

Minimalist finance celebrates simplicity. You don’t need a complex portfolio to get results:

Start with one or two ETFs aligned with your beliefs.

Automate monthly contributions to stay consistent.

Use a high-yield savings account (HYSA) alongside investments to balance growth with security.

Step 4: Track What Matters, Not Everything 🧘♀️

Avoid micromanaging. Focus on:

Growth toward your personal goals

Whether your portfolio still matches your values

Occasional rebalancing — nothing more

This approach reduces stress, decision fatigue, and “investor burnout.”

Examples of Value-Aligned Investing in Action 🌿

Sarah’s Story: She shifted her retirement fund into ESG-focused ETFs. Not only did she stay true to her belief in sustainability, but her portfolio also grew steadily over five years.

James’s Approach: Passionate about social equity, he invested in companies prioritizing diverse leadership and fair labor practices.

Lena’s Minimalist Method: She simplified her portfolio to just two sustainable funds and one impact investment, freeing up time and energy for what matters most.

Your journey can look just as intentional — and just as unique.

Final Thoughts: Grow Wealth With Purpose 🌟

Value-aligned investing is more than a financial strategy. It’s a mindset shift. It’s about:

Making your money reflect your deepest values

Building wealth without compromising your beliefs

Creating a future that feels authentic, peaceful, and aligned

You don’t have to sacrifice returns to invest intentionally. With a minimalist finance philosophy, you can grow wealth quietly and confidently while contributing to the world you believe in.

Start small. Choose one aligned investment. Automate your contributions. Let your money grow while staying true to who you are. 🌿

Comments