How to Declutter Your Finances: A 6 Step-by-Step Guide to Simplify and Gain Control

- jennifercorkum

- Aug 24, 2025

- 4 min read

Updated: Sep 1, 2025

Managing money in today’s world can feel overwhelming. Between multiple bank accounts, credit cards, investment platforms, and financial apps, it’s easy to lose track of where your money is going. If you’ve ever felt stressed or confused when checking your accounts, you’re not alone.

The good news? You can take control of your financial life by decluttering your finances. This process doesn’t just simplify money management — it reduces stress, boosts confidence, and helps you align your spending with your goals. In this guide, we’ll break down exactly how to streamline your financial landscape for clarity, control, and peace of mind.

Step 1: Create a Comprehensive List of All Accounts 🧾

Before you can declutter, you need a clear picture of everything you own and owe. Start by making a complete list of every financial account you have, including:

Bank accounts (checking and savings)

Credit and debit cards

Retirement accounts (401(k), IRA, Roth IRA, etc.)

Investment accounts (stocks, ETFs, mutual funds, crypto)

Financial apps (budgeting tools, stock trading platforms, etc.)

This step might feel intimidating at first, but it’s the foundation of financial clarity. Once you see everything laid out in front of you, you’ll feel more in control.

Pro Tip: Use a simple spreadsheet or a note-taking app to track your accounts. Include:

Account names

Balances

Login details (stored securely)

You’ll thank yourself later when everything is organized in one place.

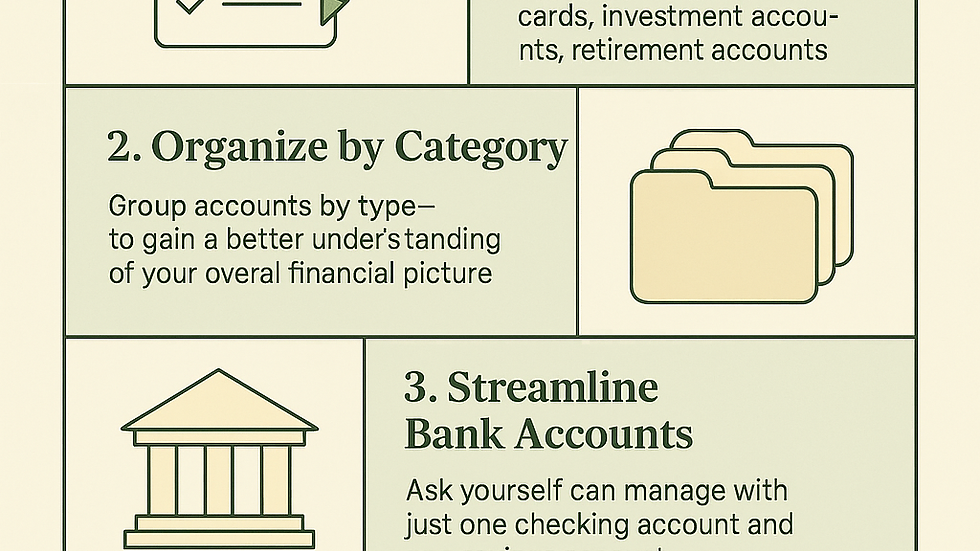

Step 2: Organize Accounts by Category 📂

Once you’ve listed everything, the next step is to group accounts into categories. This makes it easier to see where you can simplify:

Bank Accounts: Checking and savings

Credit/Debit Cards: List active cards and close unused ones

Retirement Accounts: 401(k), IRA, Roth IRA, and employer-based plans

Investments: Stock accounts, crypto wallets, ETFs, and mutual funds

Financial Apps: Budgeting, savings, and banking apps

When you organize your accounts this way, you’ll start to see patterns — like duplicate savings accounts, unused credit cards, or apps you rarely open.

Why this works: Categorization highlights areas where you can consolidate, helping you build a cleaner, more intentional financial system.

Step 3: Streamline Your Bank Accounts 🏦

Ask yourself: “Do I really need three checking accounts and four savings accounts?” Chances are, you don’t. Managing multiple accounts can be stressful and unnecessary. Consider consolidating to:

One checking account for daily expenses

One high-yield savings account (HYSA) for emergencies and short-term goals

This minimalist approach makes it easier to track balances, avoid overdraft fees, and monitor spending. I stick with one local bank for both checking and savings. Not only does it simplify my budgeting, but it also helps me build a personal relationship with my bank — something that can be useful when applying for loans or negotiating fees.

Step 4: Simplify Credit and Debit Cards 💳

Carrying around five or six cards might seem convenient, but it creates confusion and invites overspending. Instead, follow the “magic rule of one”:

One credit card with great rewards or cashback

One debit card linked to your primary checking account

If you’re highly organized, two credit cards can make sense — for example, one for travel rewards and another for everyday purchases. But beyond that, you’re adding unnecessary complexity.

Pro Tip: Always pay off your credit card balance in full to avoid interest charges and maintain a strong credit score.

Step 5: Consolidate Retirement and Investment Accounts 📈

Retirement savings are critical, but managing multiple accounts can make tracking your progress challenging. To simplify:

Stick to one employer-sponsored 401(k)

Keep one IRA or Roth IRA

Use one brokerage account for investments

If you have old 401(k)s from previous jobs, consider rolling them into a single IRA. This reduces paperwork, cuts down on fees, and makes it easier to manage your retirement strategy. For investments, less is often more. Focus on one reliable platform for buying stocks, ETFs, or mutual funds instead of scattering your money across multiple apps.

Step 6: Reduce Financial App Overload 📱

In the age of fintech, it’s easy to end up with dozens of apps — one for banking, one for investing, three for budgeting, and five for tracking credit scores. However, too many apps can lead to notification fatigue and overwhelm. Stick to the essentials:

One banking app for checking balances and managing transfers

One budgeting app (like YNAB, Mint, or Rocket Money) to track spending

One savings app if you want extra motivation to build your goals

By keeping it simple, you’ll save time and reduce the constant mental load of managing your money.

Why Decluttering Your Finances Matters 🌟

Decluttering your financial life isn’t just about fewer accounts — it’s about freedom:

Less stress: A clear, organized system means fewer headaches

More clarity: You always know where your money is and where it’s going

Better control: Simplification makes it easier to reach savings, debt, and investment goals

Confidence: When you’re on top of your finances, you feel empowered to make smarter decisions

Final Thoughts: Start Small, Start Today 🌿

Decluttering your finances doesn’t need to happen overnight. Start with one small step:

Create a list of all your accounts

Cancel unused cards

Close an old savings account

Delete financial apps you don’t need

Each little change brings you closer to a simpler, calmer, and more intentional financial life. Remember: financial freedom doesn’t come from having more — it comes from managing less.

Embrace the Journey to Financial Simplicity 🌈

As you embark on this journey, remember that every step counts. It’s not about perfection; it’s about progress. Celebrate your small victories along the way. Each decision you make to simplify your finances is a step toward a more peaceful and fulfilling life.

You deserve to feel confident and in control of your financial future. So take a deep breath, and let’s get started on this path to financial clarity together.

Comments