How to Choose the Right Credit Card for a Minimalist Lifestyle

- jennifercorkum

- Sep 25, 2025

- 3 min read

Minimalism is about simplifying your life, reducing clutter, and focusing only on what adds value. That mindset applies not just to your home or schedule, but also to your wallet. With hundreds of credit cards on the market — each promising perks, points, and “exclusive” offers — it’s easy to get overwhelmed. But from a minimalist finance perspective, you don’t need the “perfect” card. You need the right card for your lifestyle.

Let’s explore how to choose a credit card that supports minimalism, financial clarity, and freedom — without the noise.

Why Choosing the Right Card Matters

A credit card is more than a payment tool. It influences how you spend, how you budget, and even how you view money. The wrong card can:

Tempt you to overspend chasing rewards.

Drain your finances with hidden fees.

Add stress with complex reward structures.

The right card, however, supports your financial goals by offering convenience, protection, and simple benefits that truly fit your life.

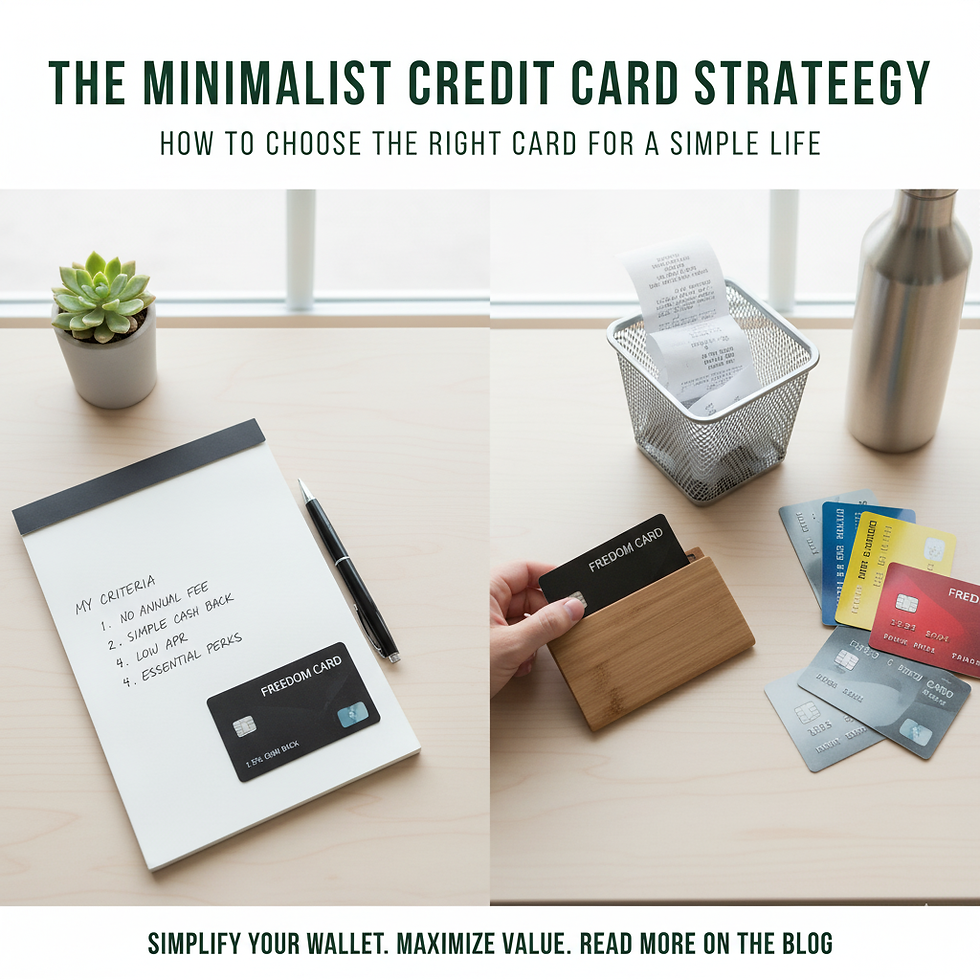

Minimalist Criteria for Choosing a Credit Card

When it comes to selecting a card, minimalists cut through the hype. Here’s what to prioritize:

1. No (or Low) Annual Fee

Why pay for something you don’t need? Many excellent cards offer rewards without annual fees. Unless you regularly travel and fully use premium perks, skip expensive cards.

2. Simple Rewards Structure

Flat-rate cashback cards (e.g., 1.5% or 2% on everything) are ideal for minimalists. They eliminate the need to track rotating categories or bonus points that complicate spending.

3. Low Interest Rate (If You Carry a Balance)

While minimalists aim to pay balances in full, life happens. A lower APR provides a safety net if you ever need it.

4. Useful Perks, Not Flashy Extras

Extended warranties, fraud protection, and no foreign transaction fees are genuinely valuable. VIP lounges and flashy perks often look appealing but go unused by most people.

5. Strong Customer Service

A simple card with excellent customer support is far more valuable than a flashy card with confusing terms and poor service.

Cards That Align With Minimalist Values

Minimalism isn’t one-size-fits-all. The best card depends on your priorities:

Cashback Minimalist: A flat-rate cashback card works for those who want simple, everyday rewards.

Traveler Minimalist: If you travel often, one low-fee travel rewards card may be worth it — but only if you use perks consistently.

Debt-Free Minimalist: If your priority is building or repairing credit, start with a no-fee secured card and focus on paying in full each month.

The common thread? One card that directly supports your lifestyle, not five cards that promise benefits you’ll never use.

What to Avoid

Minimalists are intentional about what they let in. When choosing a card, avoid:

Complicated Category Cards: Rotating rewards can push you into buying things you don’t need.

High Annual Fees: Unless you know you’ll use every perk, the cost rarely makes sense.

Cards That Encourage Debt: Teaser offers like “0% APR for 18 months” can be useful, but they can also tempt overspending.

Store Cards: Limited-use, high-interest, and often clutter your wallet with little real benefit.

If it doesn’t add value or align with your financial goals, it’s clutter.

The Financial Impact of the Right Card

Choosing the right card has ripple effects:

Saves Money: No annual fee, simple cashback, and avoided interest all protect your wallet.

Supports Budgeting: One straightforward rewards structure makes tracking spending easier.

Encourages Simplicity: Fewer cards mean fewer bills, less mental clutter, and lower risk of late fees.

Strengthens Credit: Paying one card in full consistently builds your credit history and score.

From a minimalist finance perspective, the right card becomes a tool, not a temptation.

Steps to Choose the Right Card

Audit Your Spending: Look at your top spending categories (groceries, gas, travel). Choose a card that complements your habits, not one that forces new ones.

Decide on Fees: Unless you’re a frequent traveler or heavy spender, aim for no annual fee.

Check Terms Carefully: Look beyond rewards — review APR, penalties, and perks.

Commit to One: Once chosen, commit to using and managing it well. Resist the urge to collect more “just in case.”

Automate Payments: Set autopay for the full balance each month to avoid interest and late fees.

Final Thoughts: One Card, Many Benefits

Choosing the right credit card doesn’t have to be complicated. In fact, minimalism teaches us that simplicity is the key to financial peace. One carefully chosen card can cover all your needs — providing rewards, convenience, and security without overwhelming your budget or your mind.

From a minimalist finance perspective, credit cards aren’t about maximizing every perk. They’re about aligning your money tools with your life. The truth is simple: one card, chosen wisely, can do more for you than five ever could.

Comments