How to Align Your Spending With Your Values: A Minimalist Finance Roadmap

- jennifercorkum

- Oct 27, 2025

- 5 min read

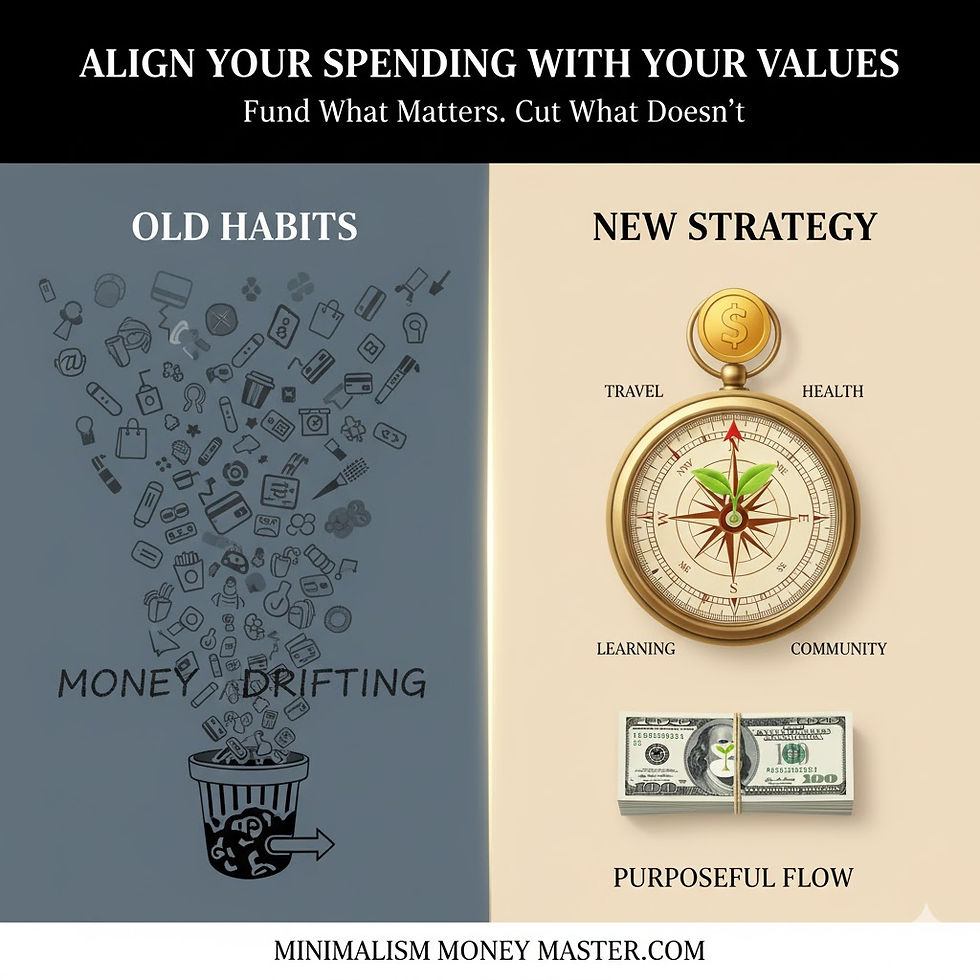

Stop wasting money on what doesn’t matter — and start funding what does.

Introduction: Your Spending Tells a Story

Every dollar you spend is a vote for the kind of life you want to live. Whether you realize it or not, your spending patterns reflect your priorities far more honestly than your words do.

Take a look at your last month’s bank statement. What story does it tell? For many of us, it’s a tale of good intentions overshadowed by habits: subscriptions we forgot to cancel, impulse purchases from late-night scrolling, daily lattes that add up. Meanwhile, the things we say we value — travel, health, freedom, generosity — often get whatever’s left over.

This is where minimalist finance comes in. By stripping away financial clutter and focusing on what truly matters, you can align your spending with your values, reduce waste, and create a life that feels both financially stable and deeply meaningful.

Here’s a practical, step-by-step roadmap to help you get there.

Step 1: Define What Actually Matters to You

Before you can align your spending with your values, you have to know your values. Many people skip this step and jump straight into budgeting or cutting costs, but without clarity, financial “minimalism” just feels like restriction.

Grab a notebook or open a blank document and ask yourself:

What brings me lasting fulfillment — not just momentary pleasure?

What kind of life do I want 5 or 10 years from now?

Which experiences or achievements make me feel most alive and proud?

If I stripped away social pressure, what would I truly prioritize?

Write down your top 3–5 core values. These might include:

Family and relationships

Health and well-being

Freedom and flexibility

Creativity and learning

Travel and experiences

Community or philanthropy

📝 Minimalist finance principle: If you don’t define your values, the market will define them for you.

When you know what matters most, your spending decisions have a compass. Every dollar either moves you closer to your vision or away from it.

Step 2: Audit Your Current Spending

Now that your values are clear, it’s time to see how your current spending compares.

Pull your last 3–6 months of transactions using bank statements, credit card summaries, or a budgeting app. Categorize your expenses into broad groups, such as:

Housing & utilities

Food & dining

Transportation

Subscriptions & entertainment

Shopping & personal spending

Travel & experiences

Savings & investments

For each category, ask:

Does this spending reflect my core values?

Am I spending out of habit, convenience, or external pressure?

Which categories bring me genuine joy and which leave me feeling empty?

This exercise is often eye-opening. You might discover, for example, that hundreds of dollars each month go to things that don’t truly matter to you — while the things you say you care about are underfunded or sporadic.

This gap is the misalignment zone. It’s where minimalist finance can make the biggest impact.

Step 3: Identify and Eliminate Value-Leaks

A value-leak is any recurring expense that doesn’t meaningfully contribute to your values or quality of life. These are often the sneakiest sources of wasted money because they feel small or automatic.

Common examples include:

Subscription services you rarely use

Impulse buys from “limited time” sales

Frequent takeout that doesn’t align with your health goals

Upgrades or status purchases that don’t improve your daily life

Lifestyle creep expenses that slipped in unnoticed

Minimalist finance isn’t about cutting everything. It’s about cutting strategically — focusing on expenses that don’t serve you, so you can free up resources for the things that do.

💡 Every dollar spent on something unimportant is a dollar not spent on something that could change your life.

Go through your categories and mark anything that doesn’t align with your core values. These are prime candidates for reduction or elimination.

Step 4: Redirect Money Toward True Priorities

Once you’ve stopped the leaks, don’t let that money just sit in your checking account waiting to be absorbed back into mindless spending. Reallocate it intentionally toward your values.

Examples:

Cancel $100 in unused subscriptions → put it toward a monthly travel fund.

Cut $200 from impulse shopping → boost your retirement contributions.

Reduce frequent dining out by $150/month → hire a personal trainer or join a class that aligns with your health goals.

Scale back on luxury upgrades → increase donations to causes you deeply care about.

This is where the transformation happens. You’re no longer just “saving money”; you’re spending in a way that reflects who you are and where you want to go.

Step 5: Automate Your Value-Based Decisions

Human willpower is finite. Even with the best intentions, it’s easy to slip back into old habits if every financial choice depends on daily discipline.

The minimalist solution: automation. Once you decide where your money should go, make it happen automatically:

Set up automatic transfers to savings, investments, or value-based funds (e.g., a “travel” or “giving” account).

Automate charitable donations to organizations you believe in.

Schedule recurring contributions to sinking funds for future goals.

Automation removes friction. Your spending starts reflecting your values by default, not by occasional effort.

Step 6: Revisit and Refine Regularly

Values can shift over time. A 25-year-old with a passion for travel may prioritize flexibility and adventure, while a 40-year-old parent might focus on stability and family. That’s why aligning spending with values isn’t a one-time exercise — it’s an ongoing minimalist practice.

Every 6–12 months, take time to:

Revisit your core values.

Re-audit your spending.

Identify new misalignments or opportunities.

Adjust your budget and automation accordingly.

Think of it like decluttering your finances regularly, just as you’d declutter a home. You keep what serves you and let go of what doesn’t.

The Financial and Emotional ROI

Aligning spending with values isn’t just about numbers — though the numbers can be powerful. It’s about creating a financial life that feels honest and intentional.

Financial ROI:

Reduced waste and unnecessary expenses

More savings and investments

Faster progress toward meaningful goals (travel, debt freedom, retirement, impact)

Emotional ROI:

Less guilt and regret about spending

More clarity and confidence in financial decisions

A deeper sense of purpose behind every dollar

Instead of money slipping through the cracks, it becomes a tool that supports your ideal life.

Conclusion: Minimalism Is About Alignment, Not Deprivation

A minimalist financial life isn’t about saying “no” to everything. It’s about saying a powerful yes to the things that matter most. When you align your spending with your values, you stop funding distractions and start building your vision intentionally.

Your money is already telling a story. The question is: is it the story you want to live?

Start small. Define your values, audit your spending, plug the leaks, and redirect with purpose. Over time, these minimalist finance habits compound — not just into a healthier bank account, but into a life that feels truly aligned.

Comments