Building a Minimalist Renewable Energy Strategy: Solar, Wind, and Long-Term Financial Clarity

- jennifercorkum

- Oct 21, 2025

- 5 min read

Over the past decade, renewable energy has moved from the margins to the mainstream. Solar panels are sprouting on rooftops, wind farms are reshaping rural landscapes, and investors are pouring capital into clean energy infrastructure.

But for many households and investors, this rapid growth comes with information overload: dozens of new companies, financing options, incentives, ETFs, and technologies. The result is often a cluttered decision-making process that feels overwhelming.

This is exactly where minimalist finance provides clarity.

Instead of chasing every trend or drowning in complexity, minimalist financial strategy filters out the noise, focuses on core principles, and builds systems designed to compound over decades — not just quarterly hype cycles.

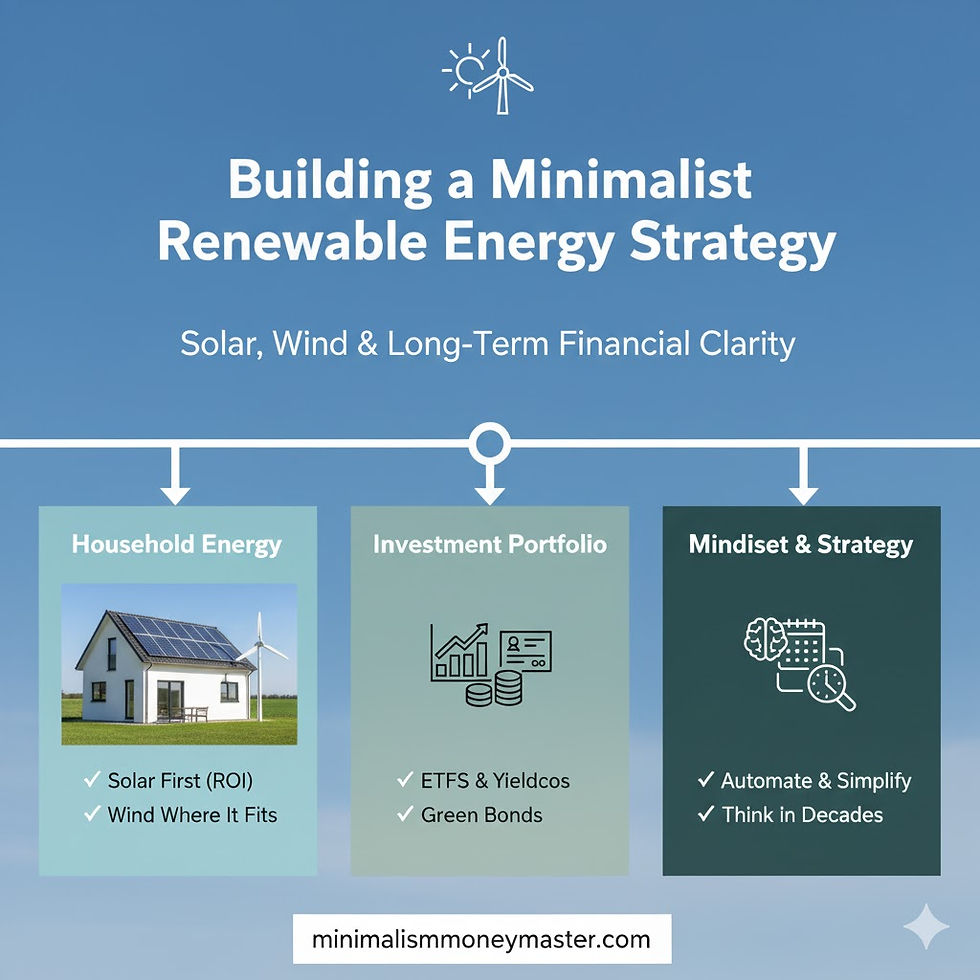

In this article, we’ll bring together the threads from solar and wind, showing you how to build a clean, long-term, minimalist renewable energy strategy — both at home and in your investment portfolio.

Why Minimalism Belongs in Renewable Energy Decisions

When people think about minimalism, they often picture clean countertops, tidy closets, or decluttered homes. But financial minimalism is deeper: it’s about intentional resource allocation, clarity of purpose, and long-term efficiency.

Renewable energy decisions — whether for your household or your portfolio — are ripe for minimalist thinking because they involve:

High upfront information load.

Long payback periods.

Recurring financial impacts over decades.

A mix of emotional, environmental, and financial motivations.

Without a clear framework, many people either get paralyzed by complexity or jump in impulsively. Minimalism offers a third way: slow down, simplify, focus on what compounds.

Step 1: Clarify Your Renewable Energy Goals

Before choosing tools, technologies, or investments, it’s essential to define your “why.”

Ask yourself:

Are you primarily aiming to lower household energy costs?

Are you looking to diversify your investment portfolio with stable, infrastructure-like assets?

Do you want to align your money with environmental values?

Or all of the above?

Minimalism starts with clarity of intention. When you know your goals, every decision — solar installation, wind ETF, or green bond — becomes easier to evaluate against that north star.

Step 2: Household Energy Strategy — Solar First, Wind Where It Fits

From a minimalist financial standpoint, household renewable energy works best when you start with the simplest, highest-ROI option and layer thoughtfully.

Start with Solar

For most households, solar is the cleanest first step:

Predictable ROI and payback period (often 7–10 years).

Straightforward installation process.

Tax credits and incentives make economics attractive.

Panels require little maintenance and last decades.

Think of solar as the foundation of your household energy strategy: a stable, cost-cutting, value-building asset.

Add Wind Only When Conditions Are Ideal

As explored earlier, small-scale wind turbines can complement solar in rural or windy coastal areas, but they require the right conditions to make sense financially.

A minimalist approach means resisting the urge to adopt technology just because it’s available. If wind doesn’t fit your property or local conditions, skip it. Simplicity is often more powerful than stacking too many systems.

Focus on Function Over Gadgets

Renewable tech is evolving fast — from smart panels to home batteries to AI energy dashboards. While some of these tools are valuable, the minimalist approach is to start with core infrastructure (panels, possibly a small turbine) and add enhancements only when they serve a clear purpose (e.g., battery backup in areas with frequent outages).

Minimalism is not anti-technology. It’s anti-waste. Start simple, layer slowly, and focus on what delivers measurable value.

Step 3: Investment Strategy — Infrastructure Over Hype

While household energy decisions reduce expenses, investing in solar and wind expands your wealth base.

Here, minimalist finance shines even brighter: the renewable sector is crowded with speculative plays — startups, volatile stocks, thematic funds — and it’s easy to get lost chasing the “next Tesla of wind” or the “AI solar disruptor.”

The minimalist investing approach focuses on infrastructure, diversification, and automation.

1. Broad Renewable Energy ETFs

ETFs that cover solar, wind, and other renewables offer diversified exposure without requiring stock picking. They reduce company-specific risk and give you long-term exposure to sector growth.

✅ Low cost

✅ Passive investing friendly

✅ Fits easily into automated contribution schedules

2. Yieldcos and Infrastructure Funds

These are companies or funds that own and operate renewable assets like wind farms and solar parks, distributing cash flows to shareholders. Think of them as the utilities of the renewable era.

Regular dividends from stable, contracted cash flows.

Infrastructure-like behavior, often less volatile than growth stocks.

Align well with long-term, minimalist income strategies.

3. Green Bonds

For fixed-income exposure, green bonds finance renewable energy projects and offer a way to align your bond allocation with sustainability goals. They can provide stability and predictability — perfect for minimalists who value steady returns.

Step 4: Integrate Solar and Wind into a Unified Financial System

The power of minimalist renewable strategy comes from integration, not accumulation.

Household systems (solar + optional wind) lower your expenses and increase property value.

Investment systems (ETFs, yieldcos, bonds) build wealth steadily in the background.

Both can be automated, monitored with minimal effort, and aligned to your long-term goals.

Think of this as financial infrastructure layering:

Personal Energy Layer → Solar panels reduce your monthly cash outflows.

Investment Layer → Wind and solar ETFs/yieldcos compound quietly over time.

Automation Layer → Automatic transfers to investment accounts, automated monitoring of system performance, annual reviews.

The result: a renewable energy strategy that runs itself, freeing your attention for more meaningful decisions.

Step 5: Avoid the Renewable “Clutter Trap”

Just as people fill their homes with gadgets they don’t use, many investors fill their portfolios with too many overlapping renewable investments:

Multiple ETFs tracking similar indexes.

Small speculative positions that dilute focus.

Frequent trading in reaction to headlines.

This clutter doesn’t improve performance; it usually hurts it.

Minimalist renewable investing is about picking a few strong vehicles and sticking with them. One broad ETF + one yieldco + perhaps some green bonds is often more than enough for well-rounded exposure.

Likewise, avoid over-engineering your home energy setup. Start with solar, monitor performance, and only add components that solve specific problems or provide clear ROI.

Step 6: Think in Decades, Act in Quarters

Renewable energy assets — both physical and financial — are long-duration investments. Panels last 25+ years. Wind farms operate for decades. Renewable ETFs benefit from multi-decade policy and economic trends.

Minimalist finance thrives on this kind of time horizon. Instead of getting caught up in monthly market swings or every policy headline, anchor your strategy in decades and review it quarterly or annually.

Quarterly/Annual Reviews:

Check system performance.

Rebalance your portfolio if needed.

Review incentives and regulations.

Daily/Monthly:

Do almost nothing. Let automation do the heavy lifting.

This mindset shift turns renewable investing from a stress-inducing project into a calm, compounding wealth engine.

Bringing It All Together

A minimalist renewable energy strategy isn’t about installing every new gadget or chasing every green stock tip. It’s about building a simple, resilient system that reduces costs, grows wealth, and aligns with your values.

At home, solar forms the foundation; wind is added only when it fits. Keep infrastructure simple and functional.

In your portfolio, focus on infrastructure exposure — ETFs, yieldcos, green bonds — and automate contributions.

In your mindset, think in decades, not news cycles. Minimalism gives you the discipline to stay focused.

Final Thought

The renewable energy transition is one of the biggest economic shifts of our lifetime. You don’t need to predict every winner, chase headlines, or clutter your finances with complexity to benefit from it.

By applying minimalist finance principles — clarity, intentionality, simplicity, and long-term thinking — you can build a renewable energy strategy that quietly compounds in the background while freeing you to focus on what matters most.

Less hype. More clarity.Less clutter. More compounding.That’s minimalist renewable finance.

Comments